ACCA AT A GLANCE

Visit www.accaglobal.com for more details.

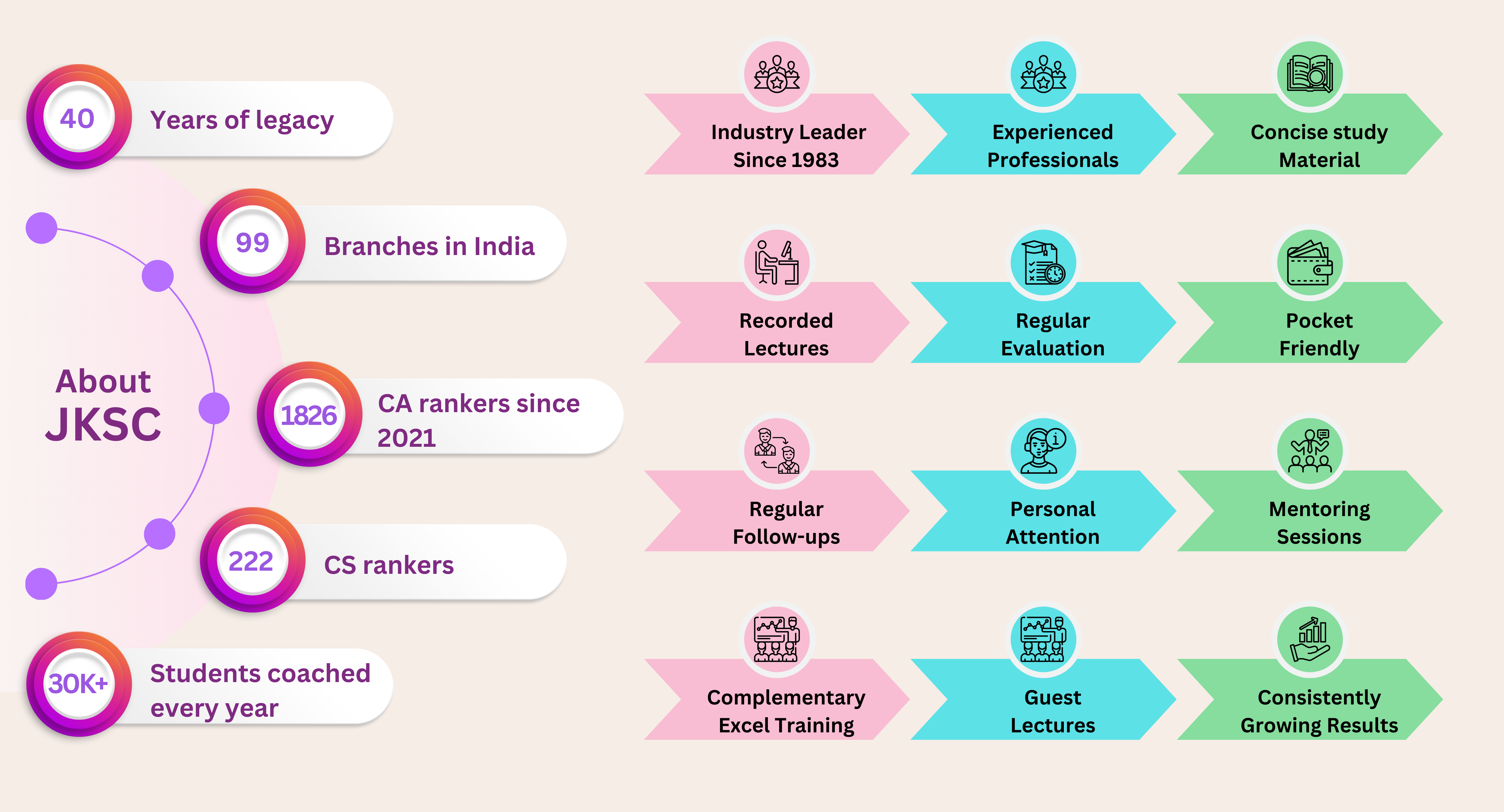

About JKSC

Eligibility Criteria - ACCA Qualification

- Eligibility requires a minimum 50% score in Class 12 commerce, with at least 65% in Accounting, Mathematics, and English.

- After 10th Class – Foundation in Accountancy (FIA) Route

After 12th Class – ACCA Route

Who should pursue ACCA?

-

You may pursue ACCA qualification:

- After grade 10 or 12

- After graduation (BCom, BMS, BBA, BAF etc)

- After Professional Qualification(CA, CA inter and so on)

Career Pathway

- Business and Technology – BT

- Management Accounting – MA

- Financial Accounting – FA

- Corporate and business Law – LW

- Performance Management – PM

- UK Taxation – TX

- Financial reporting – FR

- Audit and Assurance -AA

- Financial Management FM

-

Essential

- Strategic business Leader – SBL

- Strategic Business Reporting - SBR Optional (Any 2 out of 4)

- Advance Financial Management – AFM

- Advanced Performance Management – APM

- Advanced Taxation – ATX

- Advanced Audit and Assurance - AAA

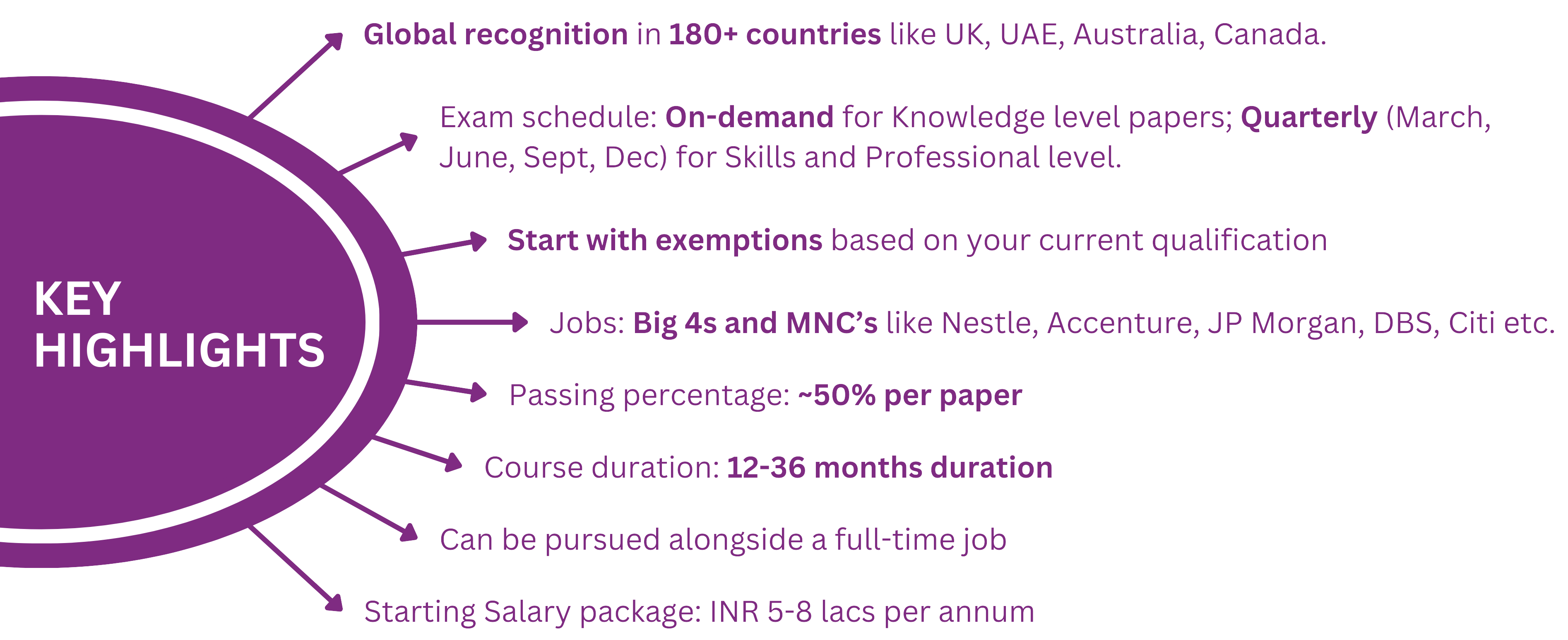

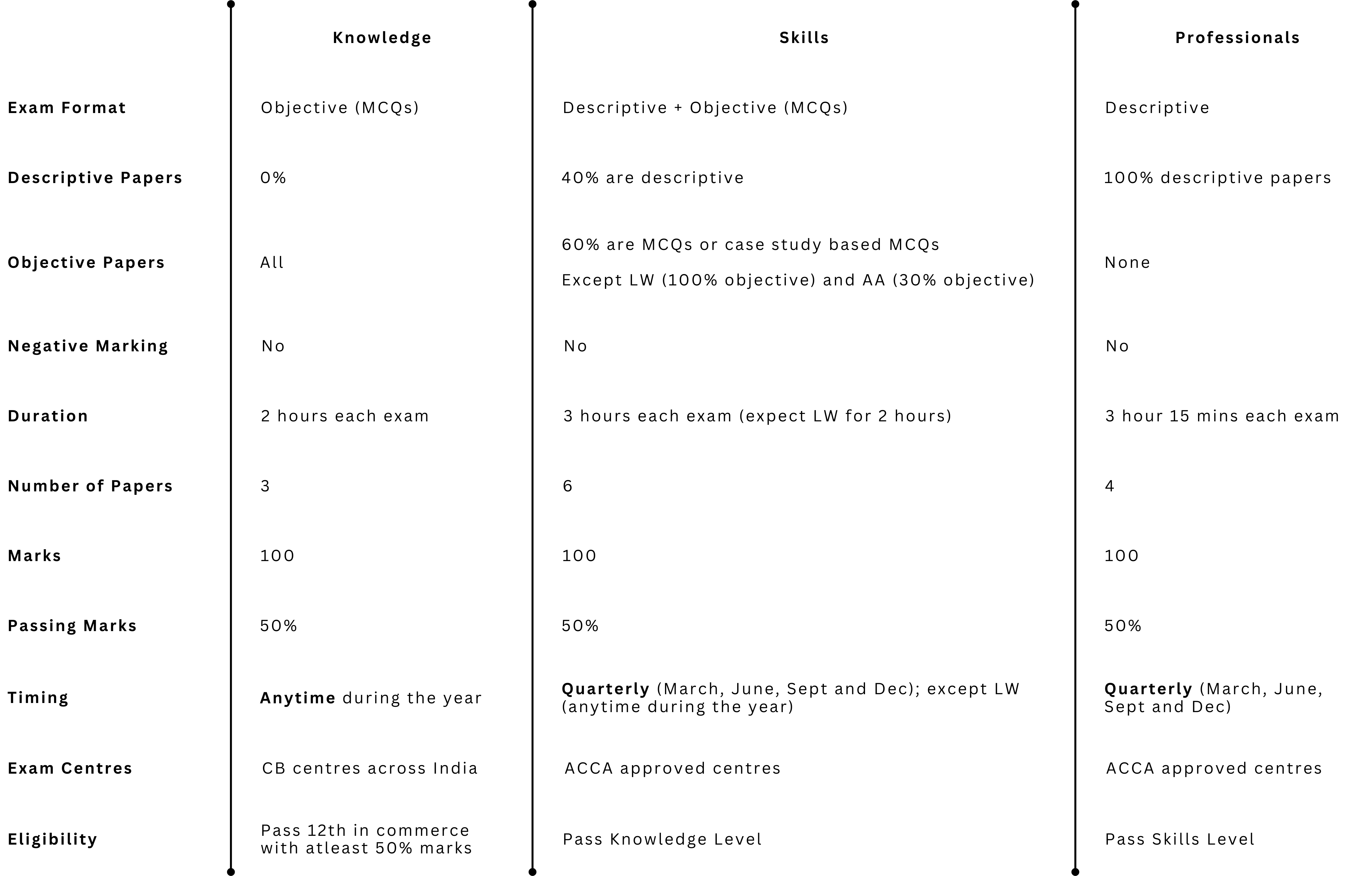

- On-demand exams (you decide when to appear for each exam)

- Exam duration: 2 hours

- Instant results

- Exams every 3 months (Mar/Jun/Sept/Dec)

- Exam duration: 3 hrs for Skills level; 3 hrs and 15 minutes for Professional level papers

- Results after ~40 Days

Passing marks for all papers: 50 out of 100 marks

Student Summary

Exemptions in ACCA

| Degree | No. Of Exemptions | Papers Exempted | Approx Course Duration |

|---|---|---|---|

| Business Degrees completed (BBA in Accounts and Finance, MBA & BBM) |

3 | BT, MA, FA | 2.5 years |

| BMS/BBA completed | 1 | BT | 3 years |

| Commerce Degrees (BCom, BAF, BBI, BFM) | 5 | BT, MA, FA, LW, TX (conditional exemption on submission of 1st Semester marksheet/Bondafide certificate from select Universities and final exemption for graduates) |

2 years |

| Cleared IPCC without Graduation till 31st Dec 2023 | 5 | BT, MA, FA, TX, AA | 2 years |

| CA Inter without Graduation From 1st Jan 2024 | 5 | MA, FA, TX, LW, AA | 2 years |

| IPCC Cleared + Graduation | 6 | BT, MA, FA, LW, TX, AA | 2 years |

| Qualified CA (ICAI) | 9 | BT, MA, FA, LW, PM, TX, FR, AA, FM | 1 year |

| Qualified US CPA | 8 | BT, MA, FA, LW, PM, TX, AA, FM | 1 year |

| Qualified CMA (INDIA) with 5 years of experience (Fellow) | 9 | BT, MA, FA, LW, PM, TX, FR, AA, FM (AA and PM not exempted for Affiliate) |

1 year |

https://www.accaglobal.com/gb/en/help/exemptions-calculator.html

ACCA Institute Fee Structure

| Particulars | Remarks | GBP | ~INR |

|---|---|---|---|

| Registration | For selected State/Central university students | GBP 20 | ~INR 2,200 |

| Others | GBP 30 | ~INR 3,300 | |

| Exemption fees through JKSC ALP | For selected State/Central university students | - | - |

| Others - per paper | GBP 15 | ~INR 1,650 | |

| Papers | |||

| Knowledge level (3 papers) | Set by CBE center - Approx. per paper | GBP NIL | ~INR 10,000 |

| Skill level (6 papers) | GBP 147 per paper | GBP 147 | ~INR 16,170 |

| Professionak (4 papers) | |||

| SBL paper | GBP 260 for SBL paper | GBP 260 | ~INR 28,600 |

| Others paper | GBP 185 per paper | GBP 185 | ~INR 20,350 |

| EPSM module | EPSM module | GBP 81 | ~INR 8,910 |

| Annual Subscription | GBP 137 per annum | GBP 137 | ~INR 15,070 |

| For selected State/Central university students | 1st year fees waived | 1st year fees waived | |

| Others | 50% waived for 1st year | 50% waived for 1st year |

ACCA fees are subject to change at discretion of the ACCA insitute.

*INR prices are calculated based on current exchange rate of 1GBP = INR 110

How ACCA Can Help Indian Professionals

Discover a new world of opportunity:

- When you study ACCA, you can take your career in any direction

- You open doors to the best and most interesting roles all over the world, and you become one of the sought-after finance professionals our fast-changing world needs.

Extend your network:

- The ACCA network helps professionals connect with fellow ACCA members to boost their future career opportunities.

Where can the ACCA qualification take you:

- ACCA members are in huge demand around the world and work in a wide range of roles, sectors, and industries

- With ACCA, you can take your career in any direction – Leading organisations recognise that having the ACCA and FCCA letters after your name guarantees expertise and an ethical way of thinking that’s underpinned by innovation, integrity, and inclusion

ACCA recognition includes but is not limited to:

- Brand and employer recognition in markets

- Statutory recognition for audit and other regulated roles and protected titles

- Professional accountancy body recognition- Mutual Recognition Agreements (MRAs), direct membership (unilateral), exemption routes

- 79% of employers say that ACCA helps grow their business by providing accountants with the skills and capabilities they need for success.

- 91% of employers agree ‘ACCA is an organisation that champions professionalism and ethics’

- 91% agree that ‘ACCA shapes the agenda of the profession'

- 87% agree that ‘ACCA is highly regarded in the market’

- 87% agree that ‘ACCA is an innovative and forward-thinking organisation’.

- The ACCA Qualification gives you the skills to make an impact in any workplace

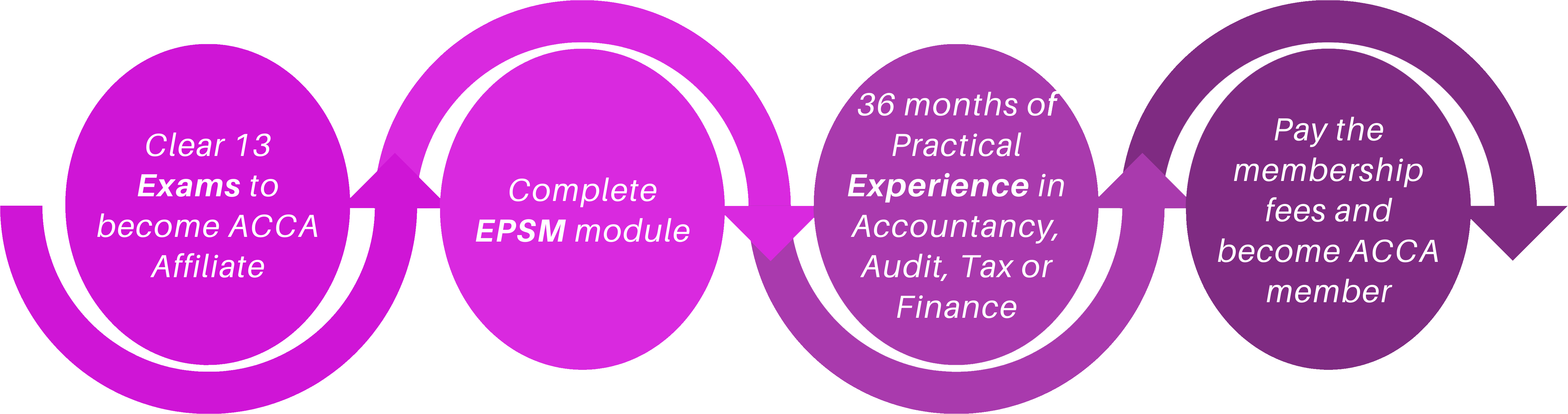

- It includes a practical experience requirement - so when you qualify, you'll already have at least three years' hands-on experience

- This makes you incredibly valuable to employers - and gives you the confidence to get your accountancy career off to a flying start

- India is emerging as the growth engine for the global economy

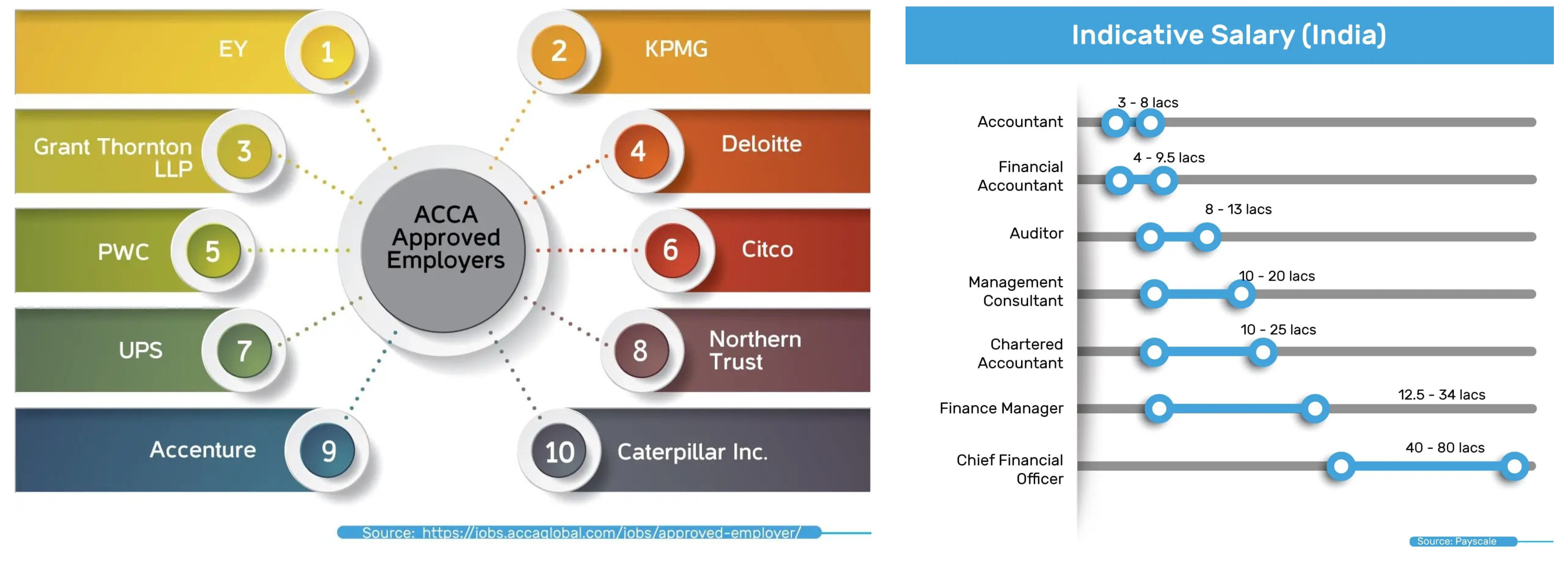

- Ernst & Young (EY), KPMG, and Grant Thornton along with other Approved employers have all used ACCA Careers to attract talent

- ACCA Careers has carried over 5,000 jobs based in India so far, this financial year.

- ACCA trainees can work in any sector and size of organisation - you don't have to work for an ACCA Approved Employer

- Your experience doesn’t have to be gained in a single role or in one continuous period and you can gain your experience in different roles and with different employers.

EMPLOYERS IN INDIA

Top Employers for ACCA

Frequently Asked Questions (FAQ’S)

The ACCA certification, offered by the Association of Chartered Certified Accountants, is a globally recognized course focusing on accounting, finance, and business management skills. Those who obtain this certification not only gain expertise in finance and accounting but also develop professional competencies such as communication and decision-making.

ACCA members, affiliates, and students secure positions in both multinational corporations such as IBM, Accenture, and Big 4 firms, as well as local enterprises like the TATA Group and Hindustan Unilever. Unless one aims to practice in India specifically and sign audited financials, holding an ACCA certification opens doors to various job opportunities.

Certainly, the ACCA course structure allows students to schedule exams at their convenience, typically held quarterly. Additionally, weekend classes offer flexibility for working professionals to balance their job commitments with their studies.

The salary for ACCA-certified individuals varies depending on factors such as skills, experience, location, and company reputation. Generally, starting salaries range from Rs. 5-7 lacs per annum, with potential increases based on various considerations.

Depending on your study plan, you can register for up to four exams per session and up to eight unique exams per calendar year.

The decision to take one or multiple exams per session depends on your available study time and other commitments.

After five years of ACCA membership and completion of Continuing Professional Development (CPD) requirements, individuals are automatically conferred the title of Fellow (FCCA).

ACCAGlobal Careers provides a platform to explore job opportunities suitable for ACCA professionals. For detailed information on various job profiles, visit https://jobs.accaglobal.com/

Indeed, the ACCA course holds international recognition and operates in over 180 countries, including prominent locations like the UK, Ireland, Canada, Singapore, and more. Many international accounting bodies establish mutual recognition agreements with ACCA, facilitating career mobility. Employers, especially multinational corporations, favor ACCA-certified individuals due to their comprehensive knowledge, strategic abilities, and adherence to ethical standards.

On average, students take 2-3 years to pass all ACCA exams, including Knowledge, Applied Skills, and Professional levels. However, the actual timeline may vary depending on any exemptions claimed.

No, completing the ACCA course does not necessitate an internship. However, a 3-year Practical Experience Requirement must be fulfilled before becoming an ACCA member. This experience can be acquired before, during, or after completing the ACCA exams.

In India, candidates must have passed Class 12th with 65% in English, Accounts, and Mathematics, along with 50% in other subjects, to pursue the ACCA course. Alternatively, candidates not meeting these criteria can opt for the Foundation in Accountancy program, which covers the initial three ACCA levels.

ACCA offers options for taking exams at home as well as centre-based sittings.

ACCA Global pass rates for individual papers typically range between 30% to 40%, with a minimum score of 50% required to pass each paper permanently.

ACCA members do not possess signing authority in India and cannot sign audit reports or establish audit firms. However, they can work in audit firms (including Big 4) as part of the audit team, with the audit report signing authority resting exclusively with members of the ICAI. Outside India, ACCA members typically have signing authority in various countries, including the UK, EU, Canada, Australia, and the Middle East.

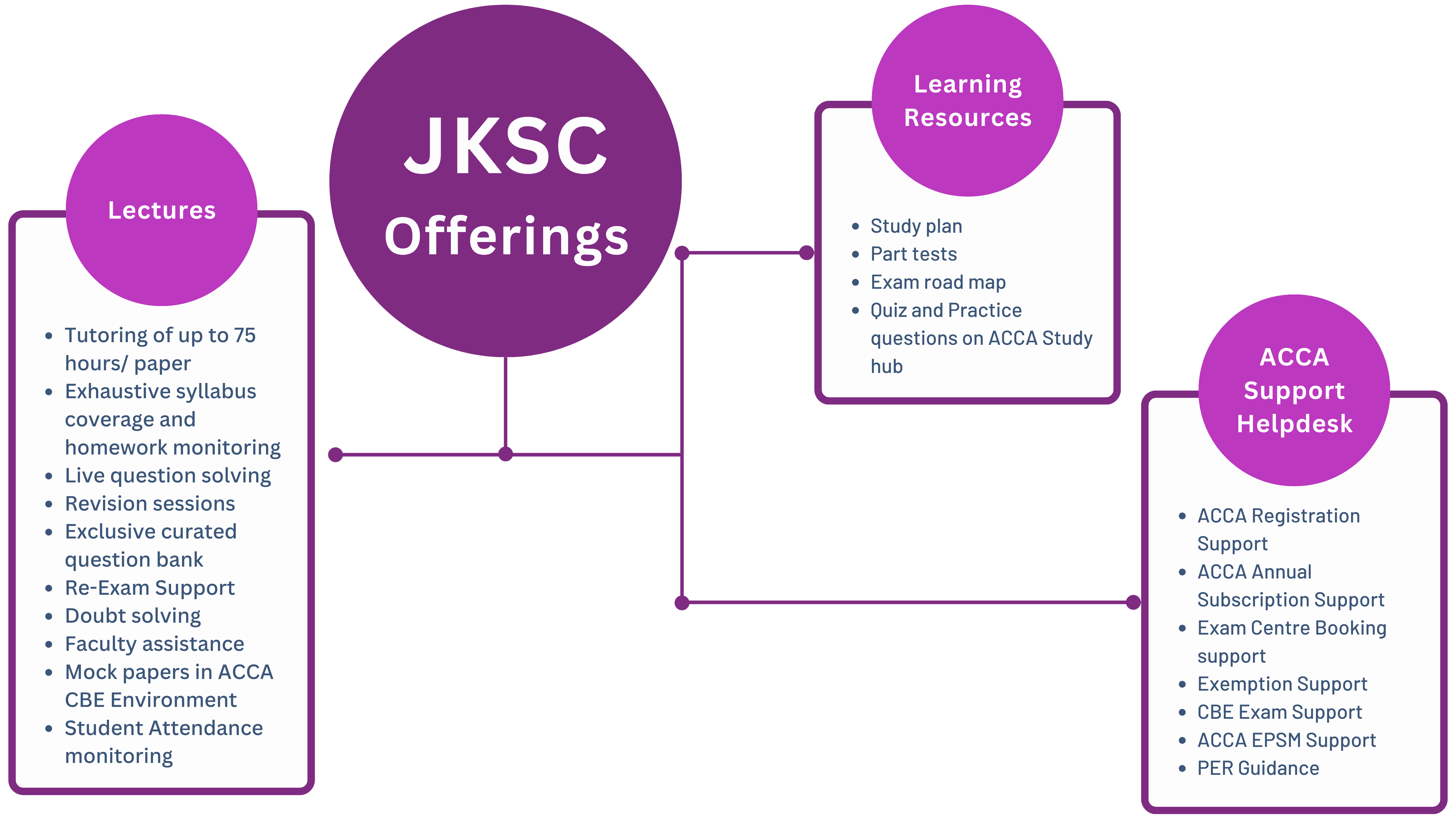

Why Choose J.K. Shah Classes?

- 40 years of experience in teaching industry with presence in 11 states across 40 cities having served more than 5 lakh+ students till date.

- Gold Learning partner

- Live classroom lectures

- ACCA qualified faculties

- On demand academic support

- Practice tests and Mock paper solving program

- Time bound completion of syllabus

- Comprehensive coverage of syllabus and focus on conceptual clarity

- Exclusive discounts for existing JKSC students.

- Cash prize for rank holders.

Placement Assistance

It is a highly sought-after qualification at Indian companies and MNCs. J. K. Shah classes is glad to extend post-qualification placement assistance to all the candidates. Our talent management cell will not only assure you of interviews with top corporates, but also assist you in resume building, soft skills training, pre placement boot camps etc.

Our end-to-end hand holding approach will ensure there are no hiccups in your professional journey right from:

Our Offline Locations

- Andheri - 4th Floor, Old Nagardas Rd, Near Chinai College, Andheri East, Shraddha, Maharashtra 400069

- Borivali – 5th, Landmark Building, Swami Vivekananda Rd, Pai Nagar, Borivali West, Mumbai, Maharashtra 400091

- Ghatkopar – RNJ Building, 3rd Floor, Near Samrat Hotel, Opp. Railway Station, Ghatkopar East, Mumbai, Maharashtra 400077

- Dadar – 184, 2nd floor, Apple Plaza, Senapati Bapat Marg, Near Kabutar khana, Dadar West, Dadar, Mumbai, Maharashtra 400028

- Mulund - 11th and 12th floor, Vikas Centre N S, NS Rd, Mulund West, Mumbai, Maharashtra 400080

JKSC Helpline For ACCA Queries:

Contact ACCA at:

ACCA Connect, 110 Queen Street, Glasgow G1 3BX, United Kingdom

www.accaglobal.com/gb/en/student.htmlJK Shah Classes does not offer visa assistance. Students enrolling from abroad are informed in advance that they are responsible for meeting all visa requirements and related documentation